13th of April 2021

ESG Ratings of RAEX-Europe are available on Cbonds

ESG ratings of 100 Russian companies, assigned by RAEX-Europe, have become available on Cbonds. These are the first ESG ratings on the Cbonds platform.

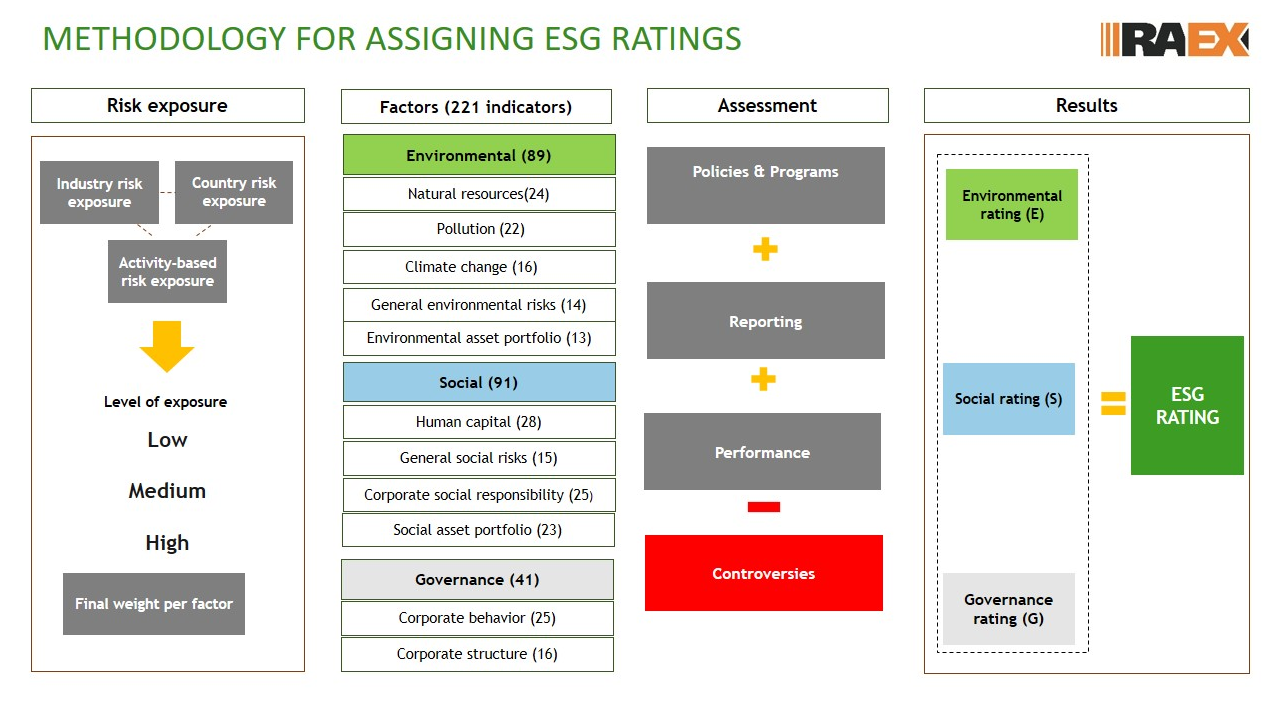

An ESG rating is determined on the basis of three areas of sustainable development: Environment, Social Responsibility, and Corporate Governance.

At the moment, ESG ratings are mainly used by institutional investors in developed countries when managing investments in securities. An ESG rating affects the amount of funds that investors are willing to invest in the issuer's securities. Since Russian companies are actively working with foreign investors when raising borrowed funds (bonds and loans), and many shares are traded on foreign exchanges, an independent ESG rating becomes an important component in assessing the attractiveness of Russian companies for foreign stakeholders. With a low ESG rating, a company may find it more difficult to raise funds, which ultimately has a negative impact on the dynamics of its shares.

The ESG rating assigned by RAEX-Europe represents the Agency's opinion on how effectively a company mitigates environmental, social, and governance risks through policies, disclosures, and ESG related performance. It also represents the Agency's views on how the company is seizing opportunities related to environmental and social factors.

For each rating, the Agency assesses the company's exposure to certain environmental, social, and governance risks in a particular country, industry, taking into account the specifics of the company's activities.

RAEX-Europe has identified three ESG rating bands:

A-rating band: The management of ESG related risks and opportunities is of high level. A company can improve the ESG score by implementing additional minor measures and innovations in the ESG related areas. 17 Russian companies were assessed within this rating band; for example, Polymetal International, Russian Railways, and Moscow Exchange.

B-rating band: The management of ESG related risks and opportunities is of moderate level. A company is required to implement a number of additional measures to mitigate those ESG risks a company is exposed to. 52 Russian companies were assessed within this rating band; for example, ALROSA, Credit Bank of Moscow, and Mail.ru Group.

C-rating band: The management of ESG related risks and opportunities is of low level. A company is required to implement numerous additional measures to mitigate those ESG risks a company is exposed to. 31 companies have ESG ratings within this rating band. Some of them are: Nizhnekamskneftekhim, Yandex, Mechel, and Promsvyazbank.

After pre-moderation, Cbonds subscribers have access to a few RAEX-Europe’s ESG rating reports in the Research Hub section, as well as on the pages of bonds and stocks of issuers mentioned in the reviews , such as Credit Bank of Moscow.

About Cbonds

The Cbonds group of companies is an information agency specializing in the financial markets. The group deals with coverage of information on securities, conducts thematic conferences, and is engaged in publishing. The Cbonds website provides information on bonds and stocks of all countries of the world, credit ratings, statistics, investment bank rankings, calendar of events, investment bank comments, and much more. Information on the Cbonds website is presented in Russian, Polish, Italian, German, French, Chinese, Ukrainian, and English.